FAQ

Frequently asked questions on CSRD and sustainability reporting

Why is sustainability reporting important?

Sustainability reporting is not just a legal requirement. It is also a communication tool that provides essential information to stakeholders. Sustainability reporting thus contributes to the transparency of a company’s operations and the impact of its business activities. Furthermore, sustainability reporting can serve as a management tool in order to analyze the status quo of the ESG performance of a company.

Is sustainability reporting mandatory?

A sustainability report is mandatory for an increasing number of companies. Whether your organization is also affected by this obligation depends on various aspects such as the number of your employees or your net sales.

Which companies will be affected by the CSRD?

The following companies are affected by the CSRD:

- Large companies with an annual average of 250 or more employees (regardless of capital market orientation) and total assets of more than €25 million or a turnover of more than €50 million

- all capital market-oriented small and medium-sized enterprises, with the exception of micro-enterprises (from 1.1.2026). According to Directive 2013/34/EU, companies are considered small if they exceed two of these three characteristics:

- 10 employees,

- €450,000 in total assets, and

- €900,000 in net sales.

Further information on the size criteria can be found in our blog post on the new CSRD thresholds.

When will the CSRD come into effect?

The timeline is depicted below:

- Companies that are already obliged to publish a sustainability report according to the national implementation of the Non-Financial-Reporting-Directive NFRD (e.g. CSR-RUG in Germany, NaDiVeG in Austria): Reporting on all fiscal years beginning on or after Jan. 1, 2024 (publication date of the report in 2025).

- Large companies that are not yet required to submit a sustainability report: reporting on all fiscal years beginning on or after Jan. 1, 2025 (publication date of the report in 2026)

- listed SMEs and small and non-complex credit institutions and captive insurance companies: Reporting on all fiscal years beginning on or after Jan. 1, 2026 (publication date of the report in 2027).

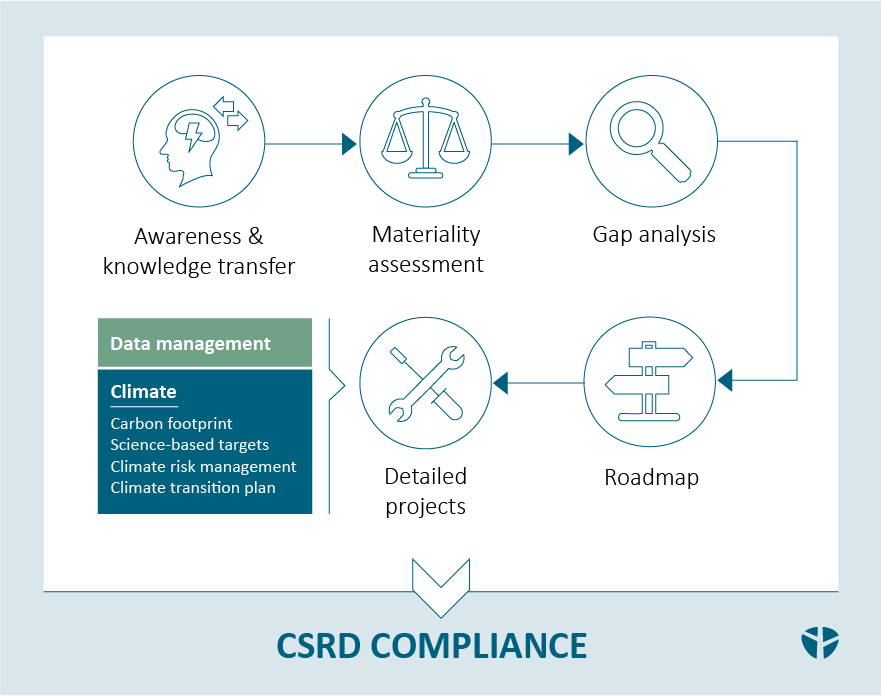

How can I prepare for the upcoming CSRD reporting regulation?

Since the CSRD will result in increased reporting obligations in the future, it is essential to deal with the upcoming changes at an early stage and to initiate appropriate measures.

As a first step, it would be particularly important to get an overview of the requirements of the current status of the ESRS (European Sustainability Reporting Standards) and to consider to what extent these are applicable to the company. It is also important to determine the current maturity level of the company concerning sustainability reporting in order to identify the additional requirements at an early stage and to plan resources accordingly. Due to the future mandatory sustainability audit, the expectations of the auditors should also be coordinated at an early stage. Our sustainability experts are pleased to support your company in these steps.