FAQ

Frequently asked questions on TCFD

What is TCFD reporting?

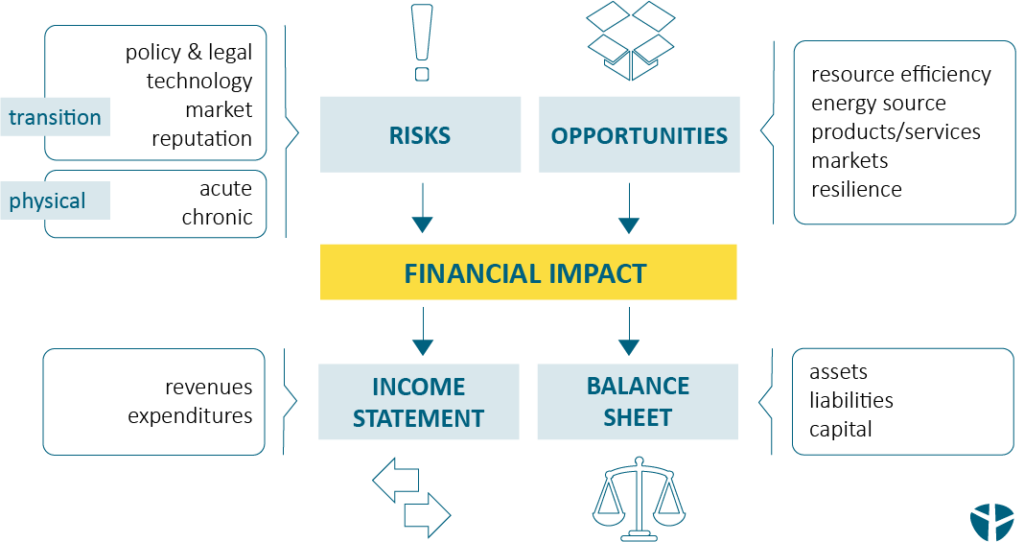

TCFD reporting focuses on the climate-related impact on companies. The TCFD framework supports companies in the disclosure of their risks.

Is TCFD reporting mandatory?

TCFD recommendations are still voluntary for most companies, although more and more governments are considering TCFD-compliant legislation. The UK government kicked things off. But as climate change has an impact on the economy worldwide, the reporting of climate-related financial information is becoming an essential part of a successful business. So, even if it is not yet mandatory for you, we recommend you deal with your company’s climate-related risks in good time.

How can I find out how climate change impacts my business?

A structured climate risk identification process shows you potential climate risks and opportunities for your company. Based on this climate risk inventory, we can perform a climate risk materiality assessment using qualitative or quantitative approaches. This reveals what climate risks are material for your business. The evaluation of the financial impact requires a deep understanding of how those material climate risks affect your business – we support you with our expertise.

What is a climate scenario analysis, and how does it work?

A climate scenario analysis is based on your current climate risk inventory and helps you understand how your current climate risk profile might develop under future climate conditions. Using established scenarios, such as those developed by IPCC, IEA, or NGFS, we perform such analyses – the basis is an established climate risk inventory and materiality assessment.

Why is a climate scenario analysis recommended?

In a climate scenario analysis, we help you to think decades ahead and assess how the future development of current risks and opportunities under different climate scenarios, such as the IPCC or IEA scenarios, might affect your company. Our approach entails developing chains of effect per material climate risk to better understand the connections between climatological variables, scenario parameters, the KPIs of our client, and financial impacts on the business. By applying climate data and other indicators from different climate scenarios, such as IPCC RCPs in these equations, we analyze how the impact on your business might be affected by future climate change. This enables you to react early on and develop and implement adaptation measures that ensure your company’s climate resilience in the near and long term.